This resource section is designed to provide you with ongoing training and support, giving you tools and techniques you need to scale your business and operate as efficiently as possible. If you have any questions or comments, don’t hesitate to reach out to me directly. My goal is to help you succeed. Let’s do this together.

1.01 Gary Nealon Accelerator Program – Competitor Ads (Length: 8.33)

Why Do Competitive Research?

Want to help your business stand out from the competition? Want to encourage more (and repeat) customers to come through your virtual doors? Then you’ll want to make competitive research a part of your marketing strategy.

Competitive research is part of a process of continuous refinement that links your business to its market. It involves assessing what your competition is doing, and seeing where they’re succeeding, and lacking, and discovering opportunities to improve your business model or product offering. Despite its importance though, it’s something that many e-commerce stores tend to neglect.

If you’re concerned that you don’t have the resources to do competitive research or market analysis full-time, don’t worry. It’s an important function and something that can be done effectively by a sole entrepreneur or small business owner.

In this guide, I’ll take you through the basics of conducting competitive analysis, and show you how you can get started.

First up, a look at a few situations when you’ll want to conduct competitive analysis:

1. When Building Your Business’ Positioning

So you want to add some muscle to your existing business proposition. Knowing your competitors clearly helps—but what about duplicating their strengths? Or, consider using Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis, and find ways to improve on their weaknesses.

Your business model or product offering doesn’t have to be entirely unique in every way, but it does need to offer some compelling advantages to what’s currently available. Competitive research is the best way to see what’s already out there, showing you what you can do to improve upon existing product offerings in some way.

2. When Formulating a New Product Offer

When you begin to plan a new product offering, it’s essential to find examples of competitive products or services that already exist. By discovering what’s good and what’s bad in your competitor’s products, you’ll find what to emphasize as key success factors (KSF) in your new offer.

It’s important to review your competitors when launching a new product. Start by checking their pricing, product specifications, and customer service expectations, then model these against your own product.

Keep in mind that it’s not just enough to be different, you’ll want to ensure that you pay attention to improvements or features that your target audience is genuinely interested in; enough so that they’re willing to pay for them.

3. When Relaunching and Promoting an Updated Product or Service

If you’re relaunching a product or thinking about running an ad campaign or promotion, this is a great opportunity to once again, see what’s working and what isn’t. The key for competitor research is reviewing potential promotion, marketing, and campaign opportunities to get noticed while entering a new market, or re-entering an old one. Check competitors’ websites and promotions, as well as non-competitor segments, to find a difference that makes a difference. What can you do to grab attention, and help your product stand out?

4. When Considering Retreating from a Category

Nobody likes giving up, but sometimes it’s necessary. An outdated business, declining sales, new regulatory hurdles—these are all reasons to consider your competitive position. Plan how your business might move, then undertake a comparative plan for your competitors. Don’t do what they expect, but don’t bet the farm on an unexpected maneuver.

Getting Started With Competitor Research

Before you begin competitive research, you’ll want to answer four key questions:

• Product – Do you have a valuable product or service to sell to an identified market? Have you confirmed interest in some way with samples of your target market?

• Customer – Can you identify a large enough group of potential customers to sell to at a profit? This is your target market, and it’s important that you find out who they are, where they spend their time, and what issues, problems, and features matter to them before you start promoting your product.

• Company – Does your company have the resources to take your product to market?

• Competitors – Who else is doing what you’re doing or planning to do, and how are you different enough to matter?

Once you’ve identified your business opportunity, then it’s time to consider your research resources. There are three types of competitor research you can use:

• In-House Research – Sometimes called desk-research, this begins at home or in the office. Look at everything you can find on your selected market, product segment, or niche. This could include research journals, trade magazines, trade fairs, and local community or national promotional activity.

• Market Research – If your budget allows, you can find a marketing or virtual agency from which to purchase research. Or, you can undertake various types of market research yourself—from surveys to trial-offers, or local advertising with an offer to gain feedback. Or consider running email campaigns that require responses to enter a competition or a sign-up newsletter in which you ask questions as part of a regular prize-draw or feedback template. Do everything you can to learn about the market and your competition, either with an agency or in-house.

• Commercial Research – This is where you purchase competitor research directly from a commercial research company. These may specialize in your niche, or they will adapt commercial research methods towards your identified needs. Yes, it can be expensive, but when compared to a marketing launch that misses the target, commercial research can be very efficient, accurate, and valuable in the long-term.

Who Are You Targeting?

A key question when conducting competitive research is: who are you targeting as customers? This approach will help you to identify multiple customer niches or segments that you can tap into.

Consider some of the following to break down your target audience:

Social Groups

The most well-known analysis for customers is the Valuation and Lifestyle Survey (VALS) which classifies your customers by breakdown of their social values from a large regular survey of consumer market information. This is basic information for every marketing campaign and keeps your targets in mind through its simple yet powerful classifications.

Local Groups

Small and medium businesses traditionally targeted the local community and multiple local markets—but the beauty of e-commerce is that you can access national or international markets just as efficiently. Still, in many cases, it’s worth considering going local. They can benefit from your physical presence, and going local can also help to keep out the competition.

National or International Markets

Your customers and competitors can also be segmented into national markets, or international ones if you’re planning on expanding into different markets. International marketing is no longer the preserve of multinational corporations alone. Although, the costs of delivery, customer service, and language translation are sometimes prohibitive for SMBs. Still, analyzing your competitors as international players who might suddenly swoop into your local or national market is a worthwhile precaution. Use the same techniques for market research to identify international competitors.

Cross-Over Markets

You could also evaluate potential cross-over markets—mix digital office products with household products and build profiles of these as competitive advantages.

Competitive Research Tools

So now that we’ve seen why it matters and what we can do with it, let’s divide competitor research into two categories: organic research and advertising research.

Organic Research – With organic research you would review competitors’ keyword usage, discover new organic competitors via social media, observe competitor position movements on sales charts and listings, or review changes in domain name use and registrations.

Advertising Research – Here you would analyze competitor ad budgets and keywords, monitor ad copy and landing pages, and discover new competitors via searching Google Ads, or Facebook Ads Libraries.

Then we begin our research using the three main sources of data today: Google, Facebook, and Amazon.

Google Ads

(Source: Google Ads)

We cover how to use Google Ads search in Gary Nealon Accelerator Program — Top Competitor Analysis In Your Niche.

Google Ads is a huge resource to begin your competitive research. It allows you to define your business by category, geography, and market size, set your keyword themes, and search competitors against these criteria. You can even write your own ads and test them.

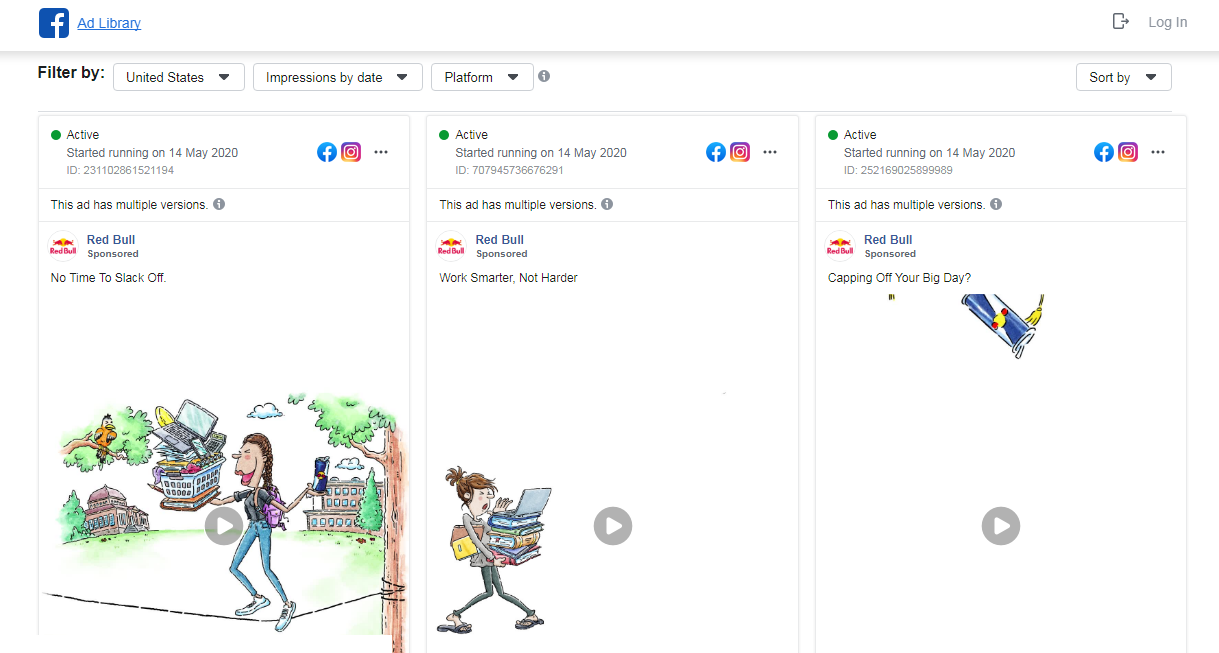

Facebook Ads Library

(Source: Facebook Ads Library)

Did you know that ninety-three percent of marketers in the U.S. invest in Facebook advertising? But before advertising, you can use Facebook Ads Library to review your competitors’ ads. Facebook Ads Library is a little-known secret that can help you to get a lot of great info for your own ad campaigns. With this free tool, you can view current ads that any company is running on Facebook. So check out your competition, and get ideas for your own campaigns.

Amazon Reseller Research

Amazon has loads of in-house research capabilities, although we’re going to focus on two programs that provide excellent competitive analysis for Amazon resellers.

SEMrush

(Source: SEMrush)

SEMrush boasts 5 million users, with the power to analyze competitor data on 710 million domain names and using more than 18 million keywords. They also offer to “uncover your competitors’ organic search, paid content, PR, and social media strategies” and to “find the most profitable keywords for your website.”

SEMrush offers a 7-day free trial and subscription membership pricing of $99.95 per month, or $199.95 per month. And if you’re subscribing as a business, $399.95 per month.

You can research SEMrush’s product range and Amazon marketing campaigns using their free PDF research reports found here.

Cerebro by Helium 10

(Source: Helium 10)

Cerebro is an Amazon research tool that offers keyword searches on all Amazon products, including exact keyword phrase search volume and estimated broad keyword phrase search volume. You can also undertake Cerebro Product Ranking searches.

Pricing includes an introductory free plan plus monthly subscriptions from $97 all the way up to the full business package at $397 per month.

Competitive Analysis Method

Now, I’ll show you the method I use to conduct competitive analysis.

Use a spreadsheet such as Airtable to open tabs and set out your competitor research framework. This is explained in (Gary Nealon Accelerator Program – Competitive Analysis 1.02).

SEMrush

Using our tried and tested case study, type into the SEMrush search box ‘Harry’s Razors.com.’

You will see a tab full of options for advertising analytics. By pressing on ‘Display Advertising,’ you display sample ads from an image library. This will also tell you what is converting well on Google.

It also shows what categories publishers are using to purchase advertising, including what types of ads and the images being used. This search includes full text for all ads in each campaign. Yes, it mainly focuses on U.S. image ads, but it also shows desktop, mobile, and HTML options.

The basic function of SEMrush is to demonstrate how publishers are using their advertising budget on different advertising platforms, which is very good information for any digital business to have.

The ‘Advertising Research’ tab displays keywords and search positions of those keywords. The ‘Rough Traffic’ tab roughly shows you dollars spent on advertising analysis of competitive spendable research. Scroll down further and you can observe product titles and product listings of google shopping and more.

Using SEMrush, you can download prescribed tables and analyses. Copy these, or links to ads, or all competitor data, and paste into your Airtable spreadsheet (or whatever database you choose to use).

An alternative platform is Ahrefs, which you can use to benchmark SEMrush if you have time. This platform offers similar tools with similar content, although they have more detail in their content descriptions. Potentially, you can use both programs, especially as a trial-period comparison.

(Source: Ahrefs)

Facebooks Ads Library

The Facebook Ads Library was buried in the site’s ads manager. It was spun out to aid transparency and to make the whole process of advertising on Facebook more open to smaller buyers.

Comparing competitor campaigns to your own campaign certainly gives you a better platform to judge your advertising market and image.

Using our case study on Harry’s Razors, search the Facebook ‘market pages’ to find their advertisements, imagery, and sales copy.

One thing that is helpful to do is to scroll through the company’s library and look for where they use the same imagery or video but with different sales copy. Finding differences between ads shows that an advertisement message is working well, because it is being reused, while the company is also trying to optimize ad impact to get the cost of reacquisition down—improving the impact and reducing costs in the process.

Next to the competitor’s name, add a link to the ad as well as the link to the sales landing page, and take a screenshot of what the ad looked like. Save all of these in your spreadsheet.

In this way, you create a database of ads for your industry. This can be used for internal company analysis. Or, if you’re using a marketing agency, give your file to them. This is a great starting point for a marketing agency, as it provides them with a database of successful ads in your industry.

Your image and advertising database is also a good resource at times of creative blocks. We use our spreadsheet of sales images to create ‘sales copy swipes’—taking existing adverts as a base and identifying key messages that we know are working, then tweaking.

You can also review what keywords your competitors are targeting in their Amazon searches. For example, type in a category search on ‘best-selling men’s razors’ to review sales volumes and competitor order of sales for an entire category. These results are powerful. If you scroll down using our case, you’ll see that Harry’s Razors were the 12th largest by sales volume in this segment at that time.

Using the Facebook Ads Library, you can download prescribed tables and analyses. Copy all competitor data and paste each data point into your Airtable spreadsheet using your prescribed research template or competitor ads category.

Cerebro by Helium 10

Open Cerebro from Helium 10. Then find the ASIN code (Amazon Standard Identification Number).

In our case, enter Harry’s Razors’ ASIN into the search box. This gives you a ton of data—all the phrases that they are using on Amazon, their search volume, Cerebro IQ score, Organic Rank on Amazon, and more. Just about all the information you would need to start running advertising campaigns targeting the same customers as your competitors.

Using Cerebro, you can download prescribed tables and analyses. Copy all competitor data and paste each data point into your growing database of analytics.

So there you have it! Who knew working with spreadsheets could be so fascinating?

Remember: Good marketers innovate, great marketers replicate. The aim of competitive research is to prevent you from wasting time or money on advertising or marketing that doesn’t work. Using data that’s available today, you can sidestep many time-consuming issues and mistakes, helping you to take your marketing efforts straight to the top.

If you’d like help executing any of the strategies in this guide, please reach out today. I’m standing by, ready to help you scale your business.